Commercial

Features

Industrial

Institutional

Net Zero

News

Interest in green building wanes, while interest in net zero grows: survey

December 7, 2020 By Anthony Capkun

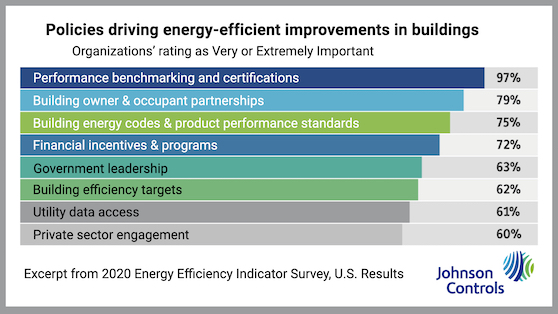

Policies driving energy-efficient improvements in buildings. Excerpt from 2020 Energy Efficiency Indicator Survey, U.S. Results © Johnson Controls.

Policies driving energy-efficient improvements in buildings. Excerpt from 2020 Energy Efficiency Indicator Survey, U.S. Results © Johnson Controls. December 7, 2020 – Johnson Controls released the findings of its annual Energy Efficiency Indicator survey, which finds more than half of organizations plan to increase investment in energy efficiency, renewable energy and smart building technology next year.

Of note, interest in achieving green building certification and leasing space in green buildings has decreased from 2019 (down 7% and 17% from last year, respectively).

Meantime, interest in net zero is up 7% from last year, with respondents saying they are Very or Extremely Likely to have one or more facilities that are nearly zero or net zero carbon, or which will achieve positive carbon or positive energy status, in the next 10 years.

Of the factors determining investment, the majority (85%) say reducing energy costs is a Very or Extremely Important driver of investment, while 76% believe protecting the health and safety of occupants during emergencies is a Very or an Extremely Important driver of investment.

“Though the pandemic has altered how people are investing in their buildings, occupant health and energy efficiency continue to be top of mind, and we anticipate these investments will be a priority in 2021 as more people return to shared spaces,” said Clay Nesler, Johnson Controls.

Despite reduced occupancy, the study finds facility energy use dropped “surprisingly little” during the pandemic, with less than 10% of facilities reducing energy use more than 20%.

As the world learns more about the spread of Covid-19 through aerosol transmission, indoor air quality has become one of the most pressing issues for facility managers to address. The survey finds that 79% have already increased air filtration (or are planning to), 3/4 have already installed an air treatment system (or are planning to), and 72% have already increased outdoor air ventilation rates (or are planning to).

The majority of respondents (81%) say increasing the flexibility of facilities to quickly respond to a variety of emergency conditions is a Very or Extremely Important driver of investment.

Furthermore, 75% of respondents’ organizations have invested in the integration of security systems with other building technology systems—a 36% increase from the 2019 study. And 1/3 of respondents plan to invest in the integration of building technology systems with distributed energy resources in the next year—a 15% increase over 2020.

“Digital offerings that integrate a number of systems are more of a priority than ever for organizations evaluating their investment plans for 2021,” said Michael Ellis, Johnson Controls.

The integration of new technology continues to be a theme, with 79% of respondents noting data analytics and machine learning will have an Extremely or Very Significant impact on buildings—up 5% from last year’s study.

Additionally, 2/3 of organizations are Very or Extremely Likely to have one or more facilities able to operate off the grid in the next 10 years—an increase of 3% from 2019. Additionally, 63% of organizations invested in onsite renewable energy in 2020.

The 2020 survey finds funding for facility improvements increasingly came from internal capital budgets (71%), energy services agreements (24%) and economic stimulus and recovery funds (20%).

The survey was conducted online to 150 energy and facility management executives across the U.S. between September 11 and October 5, 2020. Of those respondents, 27% held roles in commercial organizations, 37% in institutions, 23% in industry and 13% in Other.

You can download the survey below (PDF):

Print this page